oregon tax payment due date

The personal income tax returns filing and payment due date is extended from April 15 2020 to July 15 2020 including. 3rd 7-1 to 9-30 October 20.

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Service provider fees may apply.

. There is no discount. Quarterly Use Fuel Seller and User Tax Reports must be received by the department on or before the due dates according to the following schedule. Form OR-40 OR-40-N and OR-40-P Oregon Personal Income Tax return Form OR-41 Oregon Fiduciary return.

2021 individual income tax returns filed on extension. Mail a check or money order. Marion County encourages property owners to pay their taxes by mail.

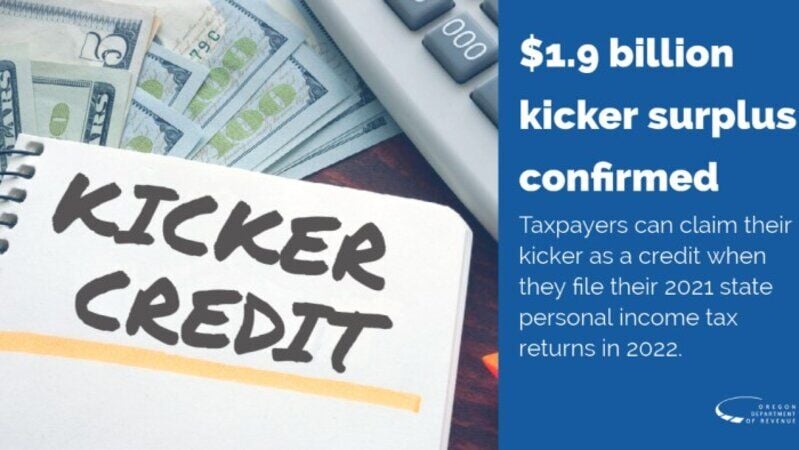

Final estimated payment due Final 25 March 15. The Oregon Office of Economic Analysis OEA confirmed a nearly 19 billion tax surplus triggering a tax surplus credit or kicker for the 2021 tax year. Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed.

Taxpayers must make their second payment for Oregons new Corporate Activity Tax CAT by July 31 2020. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. The February 1st deadline to make the 4th quarter payment for the Oregon Corporate Activity Tax CAT is coming up on us quickly.

Under the authority of ORS 305157 the director of the Department of Revenue has determined that the action of the IRS will impair the ability of Oregon taxpayers to take certain actions within the. The Oregon Department of Revenue has announced that the state of Oregon will automatically extend the tax filing and payment deadline for individual taxpayers to May 17 2021. Choose to pay directly from your bank account or by credit card.

If you receive a 2 million bonus youd pay 590000 in federal taxes on it. Electronic payment from your checking or savings account through the Oregon Tax Payment System. 4th 10-1 to 12-31 January 20.

When paying by mail please return the lower portion of your tax statements with your payment. Corporate Income and Excise. The personal income tax returns filing and payment due date is extended from April 15 2020 to July 15 2020 including.

THANKS TO OUR SPONSOR. Photo Metro Creative Connections. Oregon Corporate Activity Tax payment deadline July 31 2020.

Taxpayers that have substantial nexus with Oregon must pay taxes on their Oregon commercial activity. Oregon Corporate Activity Tax payment deadline remains April 30. After the Internal Revenue Service extended the deadline for people to file their taxes this year from April 15 to May 17.

Estimated tax payments are still due April 15 2021. 2nd 4-1 to 6-30 July 20. The Revenue Division is automatically extending the Portland and Multnomah County business tax payment due with the 2020 tax year return filing due for individuals on 4152021 until 5172021.

Quarter Period Covered Due Date. If you choose this installment schedule the second one-third payment is due on or before February 15th and the third payment is due on or before May 15. If you choose this installment schedule the final one-third payment is due on or before May 15.

Oregon has not extended the due date of the first payment for its new Corporate Activity Tax CAT. Individual taxpayers including those who pay self-employment tax can also postpone state income tax payments due on their 2020 tax year return until May 17 2021 according to a release from the Oregon Revenue Department. 2022 second quarter individual estimated tax payments.

More information about the postponement of the individual income tax filing and payment due dates is available. To review for the 2020 tax year if you expect a Corporate Activity Tax liability of 10000 or more then you are required to make estimated quarterly payments. Taxpayers may choose to pay directly from their bank account or by credit card using Revenue Online.

First estimated payment due First 50 September 15. According to IRS Notice 2020-75 in order for tax to be deductible in 2022 tax return payment must be made by end of the year. Those choosing to pay in installments will receive.

Is the department going to charge UND interest when I file my 2021 personal income tax. The Department of Revenue is joining the IRS and automatically postponing the income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17 2021. Tax Year 2020 Payment Deadline.

Both the IRS and the Oregon Department of Revenue will. Accordingly the first CAT payment is due April 30 2020. Form OR-40 OR-40-N and OR-40-P Oregon.

The second one-third payment is due by February 15 and the final one-third payment is due by May 15. Oregons April 15 2021 estimated tax payment due date for tax year 2021 has not been postponed and is still due on April 15 2021. 2022 third quarter individual estimated tax payments.

1st 1-1 to 3-31 April 20. Pay the one third payment amount on or before November 15. In step with a similar move from the federal government those filings are now due July 15 months after the usual April 15 deadline.

Pay the one third amount by November 15 no discount is allowed. Electronic payment using Revenue Online. Income tax deadline has been moved from April 15 to May 17.

Third quarter estimated payment due additional 25 December 31. Any other business tax payment due on 4152021 with a tax year 2020 combined tax return is not extended at this time. Oregon has not postponed the due date for first-quarter estimated income tax payments for 2021.

Oregon S 20 Safest Cities Of 2022 Safewise

Tax Statement Explained Lincoln County Oregon

Oregon S 20 Safest Cities Of 2022 Safewise

State Of Oregon Members Member Annual Statements Oregon Public Service Retirement Plan Opsrp Faq

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Marijuana Oregon Office Of Economic Analysis

Explore Our Free 30 Day Notice To Vacate Oregon Template 30 Day Eviction Notice 30 Day Eviction Notice

State Of Oregon Oregon Department Of Revenue Payments

2022 Oregon Logging Conference

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Blog Oregon Restaurant Lodging Association

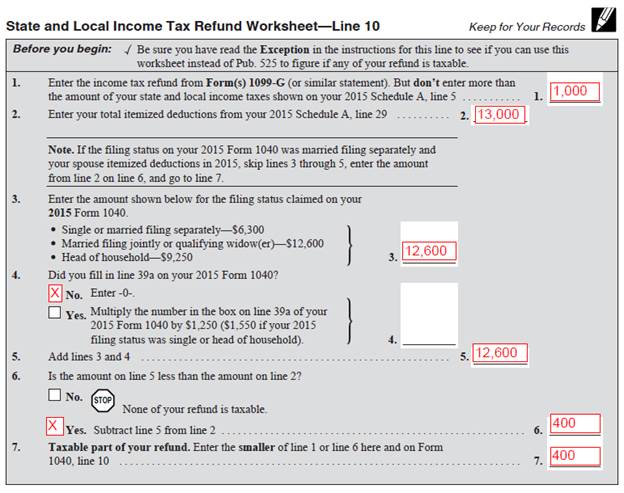

Odr 1099 G Question And Answers Oregon Association Of Tax Consultants

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon Employment Department Oremployment Twitter

Where S My Refund Oregon H R Block

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors